One extreme to another seems to be the best description when comparing the 2021 growing season to at least the start of the 2022 growing season. After the serious drought faced by many of the Manitoba and North Dakota dry bean growing areas last year, it seems we have found more moisture this spring than we know what to do with, literally, as rivers flood and fields resemble lakes. The slow planting progress faced by Manitoba growers is also facing farmers in North Dakota and here in Michigan to an extent. As of the USDA’s May 16th, crop conditions report only 4% of corn and 2% of soybeans had been planted in North Dakota. This was only 10% of the 5-year averages of 41% complete on corn and 24% on soybeans. In Michigan, after weeks of rainfall, we were finally able to catch some dry weather the last week or so and catch up on a lot of fieldwork. As of Monday’s report, we currently sit at 31% complete on corn, behind the 5-year average of 41% complete. And we are 32% complete on soybeans, slightly ahead of the 5-year average of 30%.

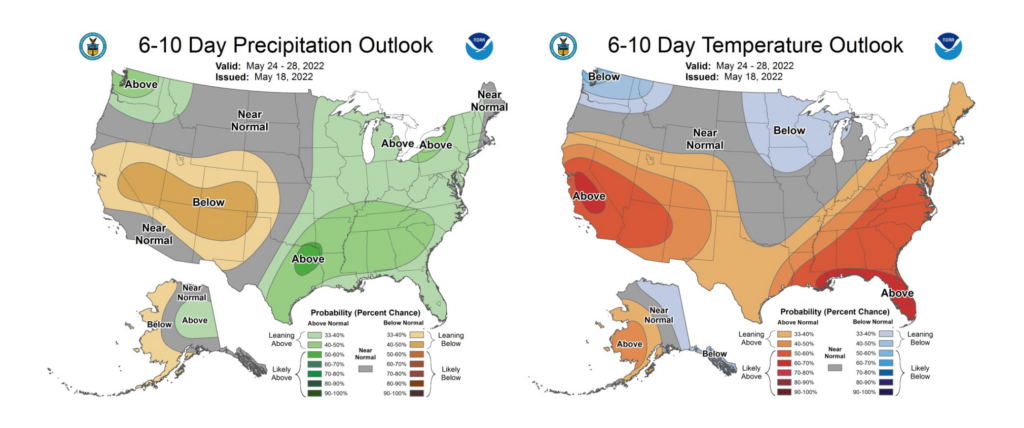

Looking ahead into the next week or so, it looks like the western U.S. growing regions of North Dakota and Minnesota will get some relief from the wet weather, however, it looks like temperatures will remain below average, which will limit any drying. Here in Michigan, it looks like we will see the exact opposite, with above-average rainfall and near normal temperatures for this time of year.

With the planting delays we’ve been discussing, we could see a couple of scenarios happen. We could potentially see some farmers who are unable to get a crop in, collect the crop insurance money for “excessive moisture” coverage if they have it; or we could see more acres shift from earlier planted crops such as corn and spring wheat to dry edible beans. If you as a grower intend to shift more acres to dry beans, it may be a good idea to consider forward contracting some of your acres to hedge your risk in case prices go down. The big question on prices will be if 2022 production will be more than enough to exceed demand since we came into the season with little to no carryover due to last year’s small crop.

Looking at the export market, we continue to see price-sensitive markets slow their imports due to these high prices. Working off that, many beans exported out of Canada are still sold in U.S. dollars, so issues with exchange rates and the inflation of the U.S. dollar have made these export prices even higher. The other big story is Mexican pinto bean imports. This past year Mexican pinto bean production was up 42% from 2020, so Mexican buyers significantly reduced their pinto bean purchases from sellers in the U.S. and Canada. Traders are eager to see what Mexican production will look like this year and how it will affect exports there in the future.

Please contact Justin or Tina with any questions on markets and new crop contracts

-Aaron Fahrner, Dry Bean Marketing Specialist Cooperative Elevator Co.